Banking as a Service (BaaS) Market Size to Reach USD 12.31 Trillion by 2032, Growing at 11.9% CAGR

Banking as a Service Market Research Report Information By, Type, Resolution, Distribution Channel, End-User, and Application.

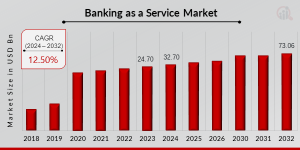

VT, UNITED STATES, September 2, 2025 /EINPresswire.com/ -- The global Banking as a Service (BaaS) market has witnessed significant expansion in recent years and is poised to experience robust growth in the coming decade. In 2023, the market size was valued at USD 4.62 trillion and is projected to grow from USD 4.75 trillion in 2024 to an impressive USD 12.31 trillion by 2032, reflecting a strong compound annual growth rate (CAGR) of 11.9% during the forecast period (2024–2032). The growth is primarily driven by the rise of digital banking adoption, fintech innovation, and growing demand for seamless financial integration across industries.Key Drivers Of Market Growth

Growing Adoption of Digital Banking

Consumers and businesses are increasingly shifting towards digital-first financial solutions. BaaS enables banks and non-banking institutions to provide online financial products, including payments, lending, and wealth management, creating a convenient and inclusive ecosystem.

Fintech Innovation and Partnerships

Fintech firms are leveraging BaaS platforms to integrate advanced financial services into their offerings without the need for a traditional banking license. This collaborative ecosystem between banks and fintechs is fostering innovation, reducing costs, and enhancing customer experiences.

Rising Demand for Embedded Finance

The expansion of e-commerce, retail, and on-demand service platforms has fueled demand for embedded finance solutions. BaaS allows companies to integrate banking services directly into their platforms, driving adoption across diverse industries such as travel, healthcare, and logistics.

Regulatory Support and Open Banking

Government regulations promoting open banking frameworks are accelerating BaaS adoption. Policies encouraging data sharing, transparency, and secure APIs are creating opportunities for both established banks and new market entrants.

Technological Advancements in API Infrastructure

Advances in API-driven banking are enabling faster, more secure, and scalable integration of financial services. Cloud computing, artificial intelligence (AI), and blockchain further enhance the efficiency and reliability of BaaS platforms.

Get a FREE Sample Report - https://www.marketresearchfuture.com/sample_request/10717

Key Companies in the Banking as a Service (BaaS) Market Include

• Solaris SE

• Green Dot Corporation

• Fidor Bank

• Bankable

• Railsbank

• Treezor

• Marqeta

• Treasury Prime

• BBVA USA

• ClearBank

• Starling Bank

• 11:FS Foundry

• Open Bank Project

• Finastra, among others

Market Segmentation

To provide a comprehensive analysis, the Banking as a Service (BaaS) market is segmented based on component, service type, enterprise size, end-user industry, and region.

1. By Component

• Platform

• Services

2. By Service Type

• Payments & Cards

• Digital Lending & Credit

• Mobile Banking

• Account & Deposits

• Compliance & Risk Management

3. By Enterprise Size

• Small & Medium Enterprises (SMEs)

• Large Enterprises

4. By End-User Industry

• Retail & E-commerce

• Healthcare

• Travel & Hospitality

• BFSI

• IT & Telecom

• Others

5. By Region

• North America: Leading market due to early adoption of digital banking and fintech partnerships.

• Europe: Driven by open banking regulations and rapid fintech innovation.

• Asia-Pacific: Fastest-growing region, supported by digital transformation, mobile banking penetration, and government initiatives in countries like India and China.

• Rest of the World (RoW): Steady growth driven by emerging digital payment ecosystems in Latin America, the Middle East, and Africa.

Purchase Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=10717

The global Banking as a Service (BaaS) market is on a trajectory of substantial growth, fueled by digital transformation, regulatory support, and the increasing need for seamless financial solutions. As businesses and consumers demand integrated and efficient financial services, BaaS is positioned to redefine the banking landscape worldwide. With strong growth prospects across industries and regions, the market presents vast opportunities for both established financial institutions and emerging fintech innovators.

Top Trending Research Report:

Check Cashing Service Market- https://www.marketresearchfuture.com/reports/check-cashing-service-market-28957

Construction Equipment Finance Market- https://www.marketresearchfuture.com/reports/construction-equipment-finance-market-28892

Credit Risk Rating Software Market- https://www.marketresearchfuture.com/reports/credit-risk-rating-software-market-28848

Cryptocurrency Hardware Wallet Market- https://www.marketresearchfuture.com/reports/cryptocurrency-hardware-wallet-market-28844

Currency Management Market- https://www.marketresearchfuture.com/reports/currency-management-market-28784

Digital Transformation In BFSI Market- https://www.marketresearchfuture.com/reports/digital-transformation-in-bfsi-market-29558

ATM Managed Service Market- https://www.marketresearchfuture.com/reports/atm-managed-service-market-29220

Banking Encryption Software Market- https://www.marketresearchfuture.com/reports/banking-encryption-software-market-29232

BFSI Crisis Management Market- https://www.marketresearchfuture.com/reports/bfsi-crisis-management-market-29251

Credit Rating Software Market- https://www.marketresearchfuture.com/reports/credit-rating-software-market-29195

Sagar Kadam

Market Research Future

+18556614441 ext.

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.