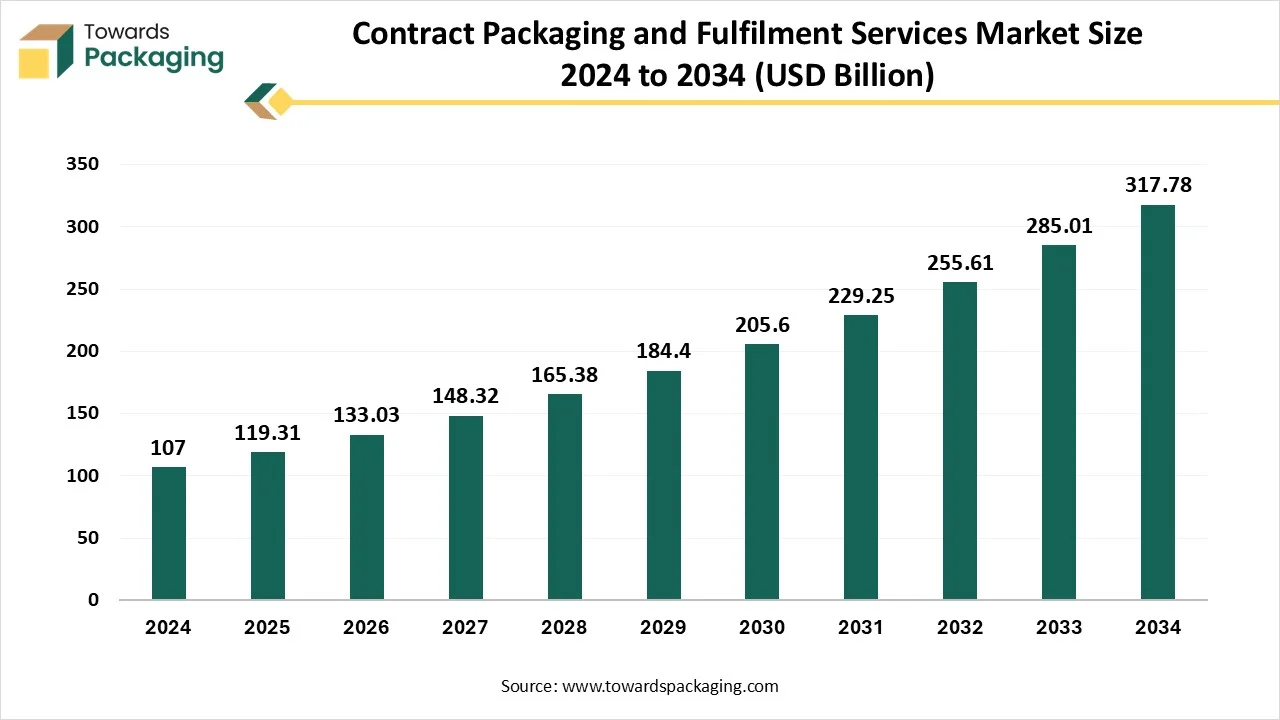

Contract Packaging and Fulfilment Services Market Drives at 11.5% CAGR

According to Towards Packaging consultants, the global contract packaging and fulfilment services market is projected to reach approximately USD 317.78 billion by 2034, increasing from USD 107 billion in 2024, at a CAGR of 11.5% during the forecast period 2025 to 2034.

Ottawa, Sept. 02, 2025 (GLOBE NEWSWIRE) -- The global contract packaging and fulfilment services market size stood at USD 119.31 billion in 2025 and is projected to reach USD 317.78 billion by 2034, according to a study published by Towards Packaging, a sister firm of Precedence Research.

The market is experiencing significant growth as companies increasingly outsource packaging, labeling, and logistics operations to improve efficiency and focus on core competencies.

Rising demand for customized packaging solutions, faster turnaround times, and scalability has positioned contract packagers as strategic partners across industries such as food and beverages, pharmaceuticals, cosmetics, consumer goods, and e-commerce.

The market is further supported by the expansion of online retail, which requires efficient order fulfilment and last-mile delivery solutions. Additionally, the growing emphasis on sustainable packaging, regulatory compliance, and value-added services like kitting and subscription box assembly is driving adoption.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5695

What is Meant by Contract Packaging and Fulfilment Services?

Contract packaging and fulfilment services refer to outsourcing packaging, assembly, labeling, and logistics operations to specialized third-party providers, allowing businesses to streamline supply chain processes and focus on core competencies.

Contract packaging, often called co-packing, includes tasks such as product assembly, bottling, blister packing, shrink wrapping, and creating retail-ready or customized packages, helping companies reduce costs and improve speed without heavy infrastructure investments.

Fulfilment services involve warehousing, inventory management, order processing, picking, packing, and shipping directly to customers or retailers, playing a vital role in the e-commerce and consumer goods industries. Together, these services ensure efficiency, compliance, scalability, and timely delivery.

What are the Key Market Trends in the Contract Packaging and Fulfilment Services Market?

- E-commerce & Omnichannel Expansion: The surge of online and direct-to-consumer sales is driving demand for versatile fulfilment solutions across multiple sales channels (retail, e-commerce, mobile), enabling brands to deliver seamless customer experiences.

- Digitalization, Automation & Smart Packaging: Adoption of automated packaging lines, robotics, AI, IoT devices, QR codes, RFID, and smart labels is boosting efficiency, traceability, and customization.

- Advanced Logistics Technologies: Innovations like IoT tracking, blockchain for transparency, AR/VR-supported warehouse processes, and real-time data analytics are enhancing fulfilment accuracy and responsiveness.

- Sustainability and Eco-friendly Packaging: Increased regulatory and consumer pressure is leading brands to prioritize green packaging using biodegradable, recyclable, and minimal materials in fulfilment operations.

- Customization, Personalization & Value-added Services: There's a rising demand for bespoke packaging and kitting solutions that enhance customer experience and strengthen brand identity.

- Localization & Fulfilment Agility: Businesses are investing in real-time inventory tracking, predictive analytics, and localized distribution models to better respond to market volatility and deliver faster, more resilient service.

-

Human–Machine Collaboration in Warehouses: Companies are increasingly integrating automation with human labor, upskilling staff to work alongside robots, balancing efficiency with workforce empowerment.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What Potentiates the Growth of the Contract Packaging and Fulfilment Services Market?

Customization and Personalization

Customization and personalization play a key role in driving the growth of the contract packaging and fulfilment services market, as consumers increasingly demand unique, branded, and eco-friendly packaging experiences. Businesses are leveraging custom packaging to enhance customer engagement, strengthen brand loyalty, and differentiate themselves in competitive markets.

In 2025, fulfilment centers will be actively investing in personalized packaging solutions to improve operational efficiency while meeting consumer expectations for tailored and sustainable packaging. This focus on customization allows companies to offer subscription boxes, limited-edition packaging, and personalized kits, highlighting the growing importance of tailored solutions in modern supply chains.

Limitations & Challenges in Contract Packaging and Fulfilment Services Market

Regulatory Compliance and Trade Barriers & Supply Chain Disruptions

The key players operating in the market are facing issues due to supply chain disruptions and regulatory compliance, which is estimated to restrict the growth of the market in the near future. The industry faces challenges in maintaining a stable workforce, leading to increased training costs and operational disruptions.

Divergent packaging and labeling regulations across regions, especially within the EU, necessitate separate production lines, increasing complexity and costs. Global events, such as the COVID-19 pandemic, have led to delays and increased costs in sourcing materials and transportation.

More Insights of Towards Packaging:

- Cleanroom Contract Packaging Service Market Innovations & Market Dynamics - The cleanroom contract packaging service market is set for substantial expansion.

- Pharmaceutical Contract Packaging Market Size - Latest Insight - The global pharmaceutical contract packaging market is projected to increase from USD 17.06 billion in 2024 to approximately USD 43.46 billion by 2034.

- Plastic Healthcare Packaging Market Research Insight: Industry Insights, Key Players, Trends, and Forecast - The plastic healthcare packaging market size is forecasted to expand from USD 27.36 billion in 2025.

- Recycled Polypropylene in Packaging Market 2025 Analysis: Flexible Packaging Leads, Rigid Segment Rising Rapidly - The recycled polypropylene in the packaging market is set to grow from USD 9.85 billion in 2025 to USD 17.66 billion by 2034.

- Microplastic Recycling Market 2025 Outlook: Secondary Products Lead While Primary Segment Surges - The global microplastic recycling market is expected to increase from USD 330.97 million in 2025 to USD 700.15 million by 2034.

- Microwave-Ready Packaging Market Accelerates in 2025 as Convenience, Sustainability, and Innovation Redefine Food Delivery Systems - The microwave-ready packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Patient-Centric Packaging Market: From Blister Packs to Smart Vials Trends Through 2034 - The patient-centric packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Dietary Supplement Packaging Market Strategic Analysis & Growth Opportunities - The dietary supplement packaging market is growing rapidly, with forecasts predicting revenue growth of hundreds of millions between 2025 to 2034.

- Omnichannel Packaging Market Insights: From Sustainability to Consumer Experience - The omnichannel packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Modified Atmosphere Packaging Trays (MAP) Market: A Fresh Solution for Food Shelf Life and Sustainability - The modified atmosphere packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

-

AI in Sustainable Packaging Market Growth, Leading Players and Strategic Insights - The global AI in sustainable packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

Regional Analysis:

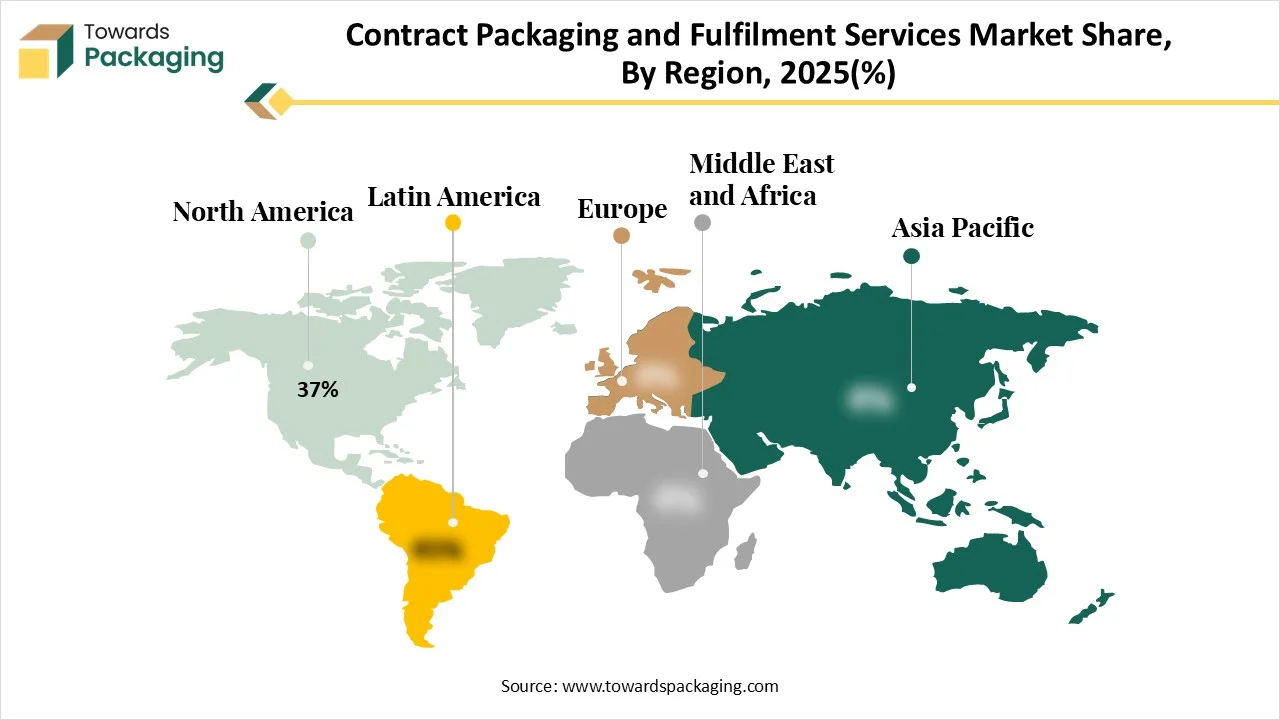

Who is the Leader in the Contract Packaging and Fulfilment Services Market?

North America dominates the contract packaging and fulfilment services market due to its well-established industrial base, advanced infrastructure, and strong presence of global e-commerce and consumer goods companies. High demand for personalized, sustainable, and premium packaging solutions drives the adoption of outsourcing services, while technological advancements such as automation, AI, and smart logistics enhance operational efficiency.

Additionally, the region benefits from robust regulatory frameworks, well-developed supply chains, and a large base of skilled workforce, enabling faster turnaround and reliable service. The growing trend of direct-to-consumer sales and omnichannel retail further reinforces North America’s leadership in this market.

U.S. Market Trends

The U.S. is a dominant player in the contract packaging and fulfilment services market, driven by the rapid expansion of e-commerce and strong demand across sectors such as food and beverage, pharmaceuticals, and consumer goods. Technological advancements, including automation, AI, and smart logistics, are enhancing operational efficiency, scalability, and accuracy.

Additionally, the country benefits from a well-established supply chain infrastructure and a large, skilled workforce, enabling rapid fulfilment and innovative packaging solutions. The focus on sustainability and regulatory compliance further supports the adoption of advanced contract packaging and fulfilment services.

Canada Market Trends

Canada’s contract packaging and fulfilment services market is growing steadily, fuelled by the rise of e-commerce and the need for efficient supply chain solutions. Increasing emphasis on sustainability and regulatory compliance is driving demand for eco-friendly and innovative packaging solutions. Moreover, Canada’s strategic location and trade agreements, such as the USMCA, facilitate cross-border logistics and enhance the appeal of Canadian providers in North America. Technological adoption and focus on operational efficiency are further supporting market growth, making Canada an important contributor to the region’s contract packaging and fulfilment landscape.

How is the Opportunistic Rise of the Asia Pacific in Contract Packaging and Fulfilment Services Market?

Asia-Pacific is the fastest-growing market for contract packaging and fulfilment services due to the rapid expansion of e-commerce in countries like China, India, and Southeast Asia, which drives strong demand for efficient packaging and timely order fulfilment. Companies are increasingly outsourcing packaging operations to reduce operational costs and minimize investments in machinery and labour.

Investments in logistics infrastructure across the region are enhancing supply chain efficiency, enabling faster and more reliable delivery. Additionally, rising consumer demand for customized and flexible packaging solutions supports the adoption of specialized contract services. Together, these factors position Asia-Pacific as a high-growth market in this sector.

China Market Trends

China’s contract packaging and fulfilment services market is growing rapidly, driven by increasing outsourcing of packaging solutions across industries such as food and beverage, pharmaceuticals, and consumer goods. The country’s robust manufacturing sector and rising e-commerce demand further support the adoption of efficient contract packaging and fulfilment solutions.

India Market Trends

India is witnessing strong growth in contract packaging and fulfilment services due to the booming e-commerce sector, rising demand for packaged food and beverages, and expanding export markets. The rapid rise of quick-commerce (Q-commerce) platforms is also fueling demand for hyperlocal warehouses in urban and Tier-2 cities, enhancing the need for efficient packaging and fulfilment services.

Japan Market Trends

Japan’s market is expanding with increasing demand for packaged products across food and beverage, pharmaceuticals, and electronics. Technological advancements, a strong manufacturing base, and a focus on innovative packaging solutions are driving market growth.

South Korea Market Trends

South Korea is seeing growth in contract packaging and fulfilment services due to rising exports, the growth of e-commerce, a strong electronics manufacturing sector, and increasing demand for eco-friendly and sustainable packaging materials.

How Big is the Success of the European Contract Packaging and Fulfilment Services Market?

Europe is experiencing notable growth in the contract packaging and fulfilment services market due to several key factors. The increasing demand for outsourced packaging services is driven by the need for cost-effective and efficient solutions across various industries. Advancements in packaging technology, such as automation and smart packaging, are transforming the contract packaging landscape, enabling companies to enhance operational efficiency and meet consumer expectations.

Additionally, sustainability and environmental considerations are influencing packaging decisions, leading to the adoption of eco-friendly materials and practices. These factors collectively contribute to the growth of the contract packaging and fulfilment services market in Europe.

U.K. Market Trends

The U.K. is witnessing robust expansion in the contract packaging sector, fuelled by the increasing demand for outsourced packaging services across industries such as food and beverage, pharmaceuticals, and consumer goods. Advancements in packaging technology, including automation and smart packaging, are enhancing operational efficiency and meeting consumer expectations.

Additionally, sustainability and environmental considerations are influencing packaging decisions, leading to the adoption of eco-friendly materials and practices. The UK's strong regulatory frameworks and infrastructure further support the growth of the contract packaging and fulfilment services market.

France Market Trends

France's contract packaging market is expanding due to the rising demand for efficient and cost-effective packaging solutions across various industries. The country's focus on sustainability and eco-friendly practices is driving the adoption of recyclable and biodegradable packaging materials. Technological advancements in packaging processes, such as automation and robotics, are improving efficiency and reducing operational costs. The growth of e-commerce and the increasing need for customized packaging solutions are also contributing to the market's expansion.

Spain Market Trends

Spain is experiencing growth in the contract packaging and fulfilment services market, driven by the increasing demand for outsourced packaging services from end-users in various sectors. The country's investments in logistics infrastructure are enhancing supply chain efficiency, facilitating faster and more reliable delivery of goods. The rise of e-commerce and the need for flexible and efficient packaging solutions are further propelling market growth.

How Crucial is the Role of Latin America in the Contract Packaging and Fulfilment Services Market?

Latin America is experiencing notable growth in the contract packaging and fulfilment services market due to several key factors. The rapid expansion of e-commerce, driven by increased internet penetration and changing consumer behaviors, has significantly boosted demand for efficient packaging and fulfilment solutions. Companies are increasingly outsourcing packaging functions to specialized third-party providers to focus on core competencies and reduce operational costs.

Additionally, advancements in packaging technologies, such as automation and smart packaging, are enhancing efficiency and meeting consumer expectations. The region's diverse consumer base and growing middle class further contribute to the market's expansion. These factors collectively drive the growth of the contract packaging and fulfilment services market in Latin America.

How does the Middle East and Africa Lead the Contract Packaging and Fulfilment Services Market?

The Middle East and Africa (MEA) is experiencing significant growth in the contract packaging and fulfilment services market, driven by several key factors. The rapid expansion of e-commerce, with retail penetration rates ranging from approximately 11% to 12%, has significantly boosted demand for efficient packaging and fulfilment solutions. Companies are increasingly outsourcing packaging functions to specialized third-party providers to focus on core competencies and reduce operational costs.

Additionally, advancements in packaging technologies, such as automation and smart packaging, are enhancing efficiency and meeting consumer expectations. The region's diverse consumer base and growing middle class further contribute to the market's expansion. These factors collectively drive the growth of the contract packaging and fulfilment services market in the Middle East and Africa.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Service Type Insights

The contract packaging segment holds dominance in the contract packaging and fulfilment services market due to several key factors. Companies across industries, particularly food & beverages, pharmaceuticals, and personal care, increasingly outsource packaging to specialized providers to reduce operational costs, ensure regulatory compliance, and improve supply chain efficiency.

The demand for advanced and innovative packaging formats, such as sustainable, tamper-proof, and customizable solutions, has further strengthened reliance on contract packaging partners. Additionally, the rising need for scalability, faster turnaround times, and packaging expertise to meet changing consumer expectations makes contract packaging a more reliable and cost-effective choice compared to in-house packaging operations.

The fulfilment services segment is the fastest-growing segment in the market due to the rapid rise of e-commerce, omnichannel retail, and direct-to-consumer business models. Increasing online shopping has created strong demand for efficient warehousing, inventory management, order processing, and last-mile delivery solutions.

Companies are outsourcing fulfilment to specialized providers to reduce logistics costs, enhance scalability, and ensure faster deliveries that align with consumer expectations. Moreover, the integration of digital technologies such as AI, robotics, and real-time tracking in fulfilment centers is improving accuracy and efficiency, making fulfilment services a critical growth driver in the market.

Packaging Material Insights

The plastic segment dominates the contract packaging and fulfilment services market due to its versatility, durability, and cost-effectiveness. Plastic offers excellent barrier properties, protecting products from moisture, contamination, and damage during storage and transportation, making it highly suitable for industries like food & beverages, pharmaceuticals, and consumer goods.

Its lightweight nature reduces shipping costs and enhances logistics efficiency, while its adaptability allows for a wide range of formats such as bottles, pouches, blister packs, and containers. Additionally, ongoing innovations in recyclable and biodegradable plastics address sustainability concerns, reinforcing their widespread adoption as the preferred material in contract packaging.

The biodegradable/compostable materials segment is the fastest-growing segment in the market due to increasing global emphasis on sustainability and environmental responsibility. Rising regulatory pressures and government initiatives promoting eco-friendly packaging solutions are driving adoption across industries such as food & beverage, personal care, and e-commerce.

Growing consumer awareness and preference for green packaging are further accelerating demand. In addition, advancements in material science have improved the performance, durability, and cost-effectiveness of biodegradable packaging, making it a viable alternative to conventional plastics. These factors collectively position biodegradable and compostable materials as the fastest-growing packaging segment.

Business Model Insights

The B2B fulfilment segment dominates the contract packaging and fulfilment services market due to the high volume and bulk nature of orders processed between manufacturers, wholesalers, and retailers. Businesses rely on B2B fulfilment providers to manage large-scale inventory, streamline logistics, and ensure timely distribution to maintain supply chain efficiency.

The segment benefits from strong demand in industries such as pharmaceuticals, consumer goods, and industrial products, where accuracy, compliance, and reliability are critical. Additionally, the growth of global trade and cross-border transactions has reinforced the need for specialized B2B fulfilment services that can handle complex logistics, customs, and large-order management effectively.

The D2C fulfilment segment is the fastest-growing segment in the market due to the surge in e-commerce, subscription boxes, and brand-owned online stores. Consumers increasingly prefer direct engagement with brands for personalized experiences, faster deliveries, and exclusive product offerings, driving demand for specialized D2C fulfilment solutions.

This segment benefits from advanced last-mile delivery systems, real-time order tracking, and customized packaging that enhances brand identity. Additionally, small and mid-sized businesses are leveraging D2C models to bypass intermediaries and reduce costs, fueling rapid adoption. These factors make D2C fulfilment the fastest-expanding segment in the market.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Company Size Insights

The large enterprises segment dominates the contract packaging and fulfilment services market due to their extensive production volumes, global distribution networks, and strong financial capabilities to invest in outsourcing partnerships. These companies prioritize efficiency, scalability, and compliance, making contract packaging providers essential for handling complex packaging requirements across multiple product categories.

Large enterprises also demand advanced technologies, automation, and sustainable packaging solutions, which specialized service providers are well-equipped to deliver. Moreover, their strong brand presence and customer base require consistent quality and timely delivery, further reinforcing their reliance on professional contract packaging and fulfilment services, thereby securing their market dominance.

The small and medium enterprises (SMEs) segment is the fastest-growing in the market due to their increasing adoption of outsourcing to reduce operational costs and focus on core business activities. SMEs often lack the infrastructure and capital to manage large-scale packaging and logistics, making third-party service providers an attractive solution.

The rise of e-commerce and digital platforms has enabled SMEs to reach wider markets, driving demand for flexible, scalable, and cost-efficient fulfilment services. Additionally, SMEs benefit from customized packaging solutions, quick turnaround times, and access to advanced technologies, fueling their rapid growth within the market.

End-Use Industry Insights

The food and beverages segment dominates the contract packaging and fulfilment services market due to the consistently high demand for packaged food, ready-to-eat meals, beverages, and convenience products. Strict regulations on food safety and hygiene drive companies to rely on specialized contract packagers with expertise in compliant, high-quality packaging solutions.

The segment benefits from the need for diverse packaging formats such as bottles, cans, pouches, and cartons that preserve freshness, extend shelf life, and enhance branding. Additionally, rising consumer preferences for sustainable and innovative packaging, along with the rapid growth of e-commerce grocery delivery, further strengthen this segment’s market dominance.

The personal care and cosmetics segment is the fastest-growing in the market due to rising consumer demand for premium, customized, and aesthetically appealing packaging that enhances brand identity. Increasing online beauty sales, influencer-driven marketing, and subscription box models have created strong demand for specialized fulfilment and attractive packaging solutions.

Consumers seek eco-friendly, sustainable, and travel-friendly formats, driving brands to outsource to contract packagers with advanced design and material capabilities. Moreover, rapid product launches, seasonal collections, and personalization trends require flexible, scalable, and quick-turnaround packaging, making this segment expand faster than other end-use industries.

Channel Type Insights

The e-commerce segment dominates the contract packaging and fulfilment services market due to the rapid growth of online shopping across industries such as food & beverages, personal care, electronics, and fashion. E-commerce businesses require efficient packaging and fulfilment solutions to ensure timely delivery, product safety, and customer satisfaction.

The rise of direct-to-consumer (D2C) models and subscription-based services further increases demand for outsourced packaging and logistics. Additionally, the need for customized, protective, and branded packaging that enhances the unboxing experience makes e-commerce companies rely heavily on specialized contract packaging and fulfilment providers, solidifying this segment’s market dominance.

The omnichannel segment is the fastest-growing channel-type segment in the market due to the increasing demand for seamless integration between online and offline sales channels. Retailers and brands aim to provide consistent customer experiences across e-commerce platforms, physical stores, and mobile applications, driving the need for flexible and scalable packaging and fulfilment solutions.

Omnichannel operations require real-time inventory management, rapid order processing, and reliable last-mile delivery, which specialized contract service providers offer. Additionally, growing consumer expectations for fast, accurate, and personalized deliveries are accelerating the adoption of omnichannel fulfilment strategies, fueling the segment’s rapid growth.

Access our exclusive, data-rich dashboard dedicated to the Contract Packaging and Fulfilment Services Market built specifically for decision-makers, strategists, and industry leaders. This interactive platform provides comprehensive statistical insights, segment-wise market breakdowns, regional performance analysis, detailed company profiles, annual updates, and much more. From market sizing and growth projections to competitive intelligence and regulatory trends, our dashboard serves as a one-stop solution to empower smarter decisions in the fast-evolving sustainable packaging industry.

Access Now: https://www.towardspackaging.com/contact-us

Recent Breakthroughs in the Market:

- In July 2025, the third-party logistics (3PL) company Kenco established a Contract Packaging Division that deals with secondary packaging. The company claims that this move will make things easier for its clients and solidify its standing as a one-stop supply chain management resource.

- In July 2025, Amazon opened a state-of-the-art fulfilment center in Nagoya, Japan, that incorporates cutting-edge solar and geothermal technology to reduce its environmental impact. The building has rooftop and parking lot solar panels, but it is the first Amazon facility in the world to have vertical solar panels on the outside walls of the building. The 5.5 megawatt (MW) system that these installations create is the biggest on-site capacity of solar projects in Amazon's portfolio outside of the U.S.

Contract Packaging and Fulfilment Services Market Players

- Sonoco Products Company

- Sonic Packaging Industries Inc.

- Deufol SE

- Unicep Packaging LLC

- Multipack Solutions LLC

- Stamar Packaging

- Assemblies Unlimited Inc.

- Green Packaging Asia

- Aaron Thomas Company Inc.

- Sharp Packaging Services

- Tjoapack Netherlands B.V.

- Jones Healthcare Group

- DHL Supply Chain (Fulfilment)

- Ryder System Inc.

- ShipBob Inc.

- FulfilmentCompanies.net

- Amcor plc (Contract Packaging arm)

- Catalent Pharma Solutions

- WePack Ltd.

- Merrill Corporation Shape, Picture

Contract Packaging and Fulfilment Services Market Segments

By Service Type

- Contract Packaging

- Primary Packaging

- Blister Packaging

- Bottle Filling

- Sachet Packaging

- Strip Packaging

- Vial/Ampoule Packaging

- Pouch Packaging

- Secondary Packaging

- Cartoning

- Shrink Wrapping

- Labeling

- Overwrapping

- Bundle Packaging

- Tertiary Packaging

- Palletizing

- Crating

- Bulk Packaging

- Primary Packaging

- Fulfilment Services

- Order Fulfilment

- Warehousing and Inventory Management

- Kitting and Assembly

- Pick and Pack

- Reverse Logistics

- Subscription Box Fulfilment

- Drop Shipping

By Packaging Material

- Plastic

- Rigid

- Flexible

- Paper and Paperboard

- Glass

- Metal

- Biodegradable/Compostable Materials

- Foam

By End-Use Industry

- Food and Beverage

- Frozen Food

- Dairy

- Beverages

- Snacks and Confectionery

- Ready-to-eat Meals

- Pharmaceuticals

- Prescription Drugs

- OTC Medicines

- Nutraceuticals

- Personal Care and Cosmetics

- Skincare

- Haircare

- Toiletries

- Consumer Electronics

- Household Products

- Industrial Goods

- Apparel and Fashion

- Pet Care

By Business Model

- B2B Fulfilment

- B2C Fulfilment

- D2C Fulfilment

- Hybrid Models

By Company Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Channel Type

- E-commerce

- Retail (Offline)

- Omni-channel

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5695

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.